Fund update: CRUX European Special Situations Fund

By Richard Pease

We thought it would be helpful to provide some background on Richard Pease’s European fund performance at key points of market dislocation over the last 25 years.

After the market bottomed in key periods of dislocation, ie 2000, 2003 and 2010, Richard’s funds have consistently outperformed on 1,2 & 3 year periods. While all these periods of market turbulence were determined by different factors, what is clear is that ESSF is a strategy one should hold in such an environment. Our focus on business strategy, management quality, sound financials and attractive valuations all contribute to this.

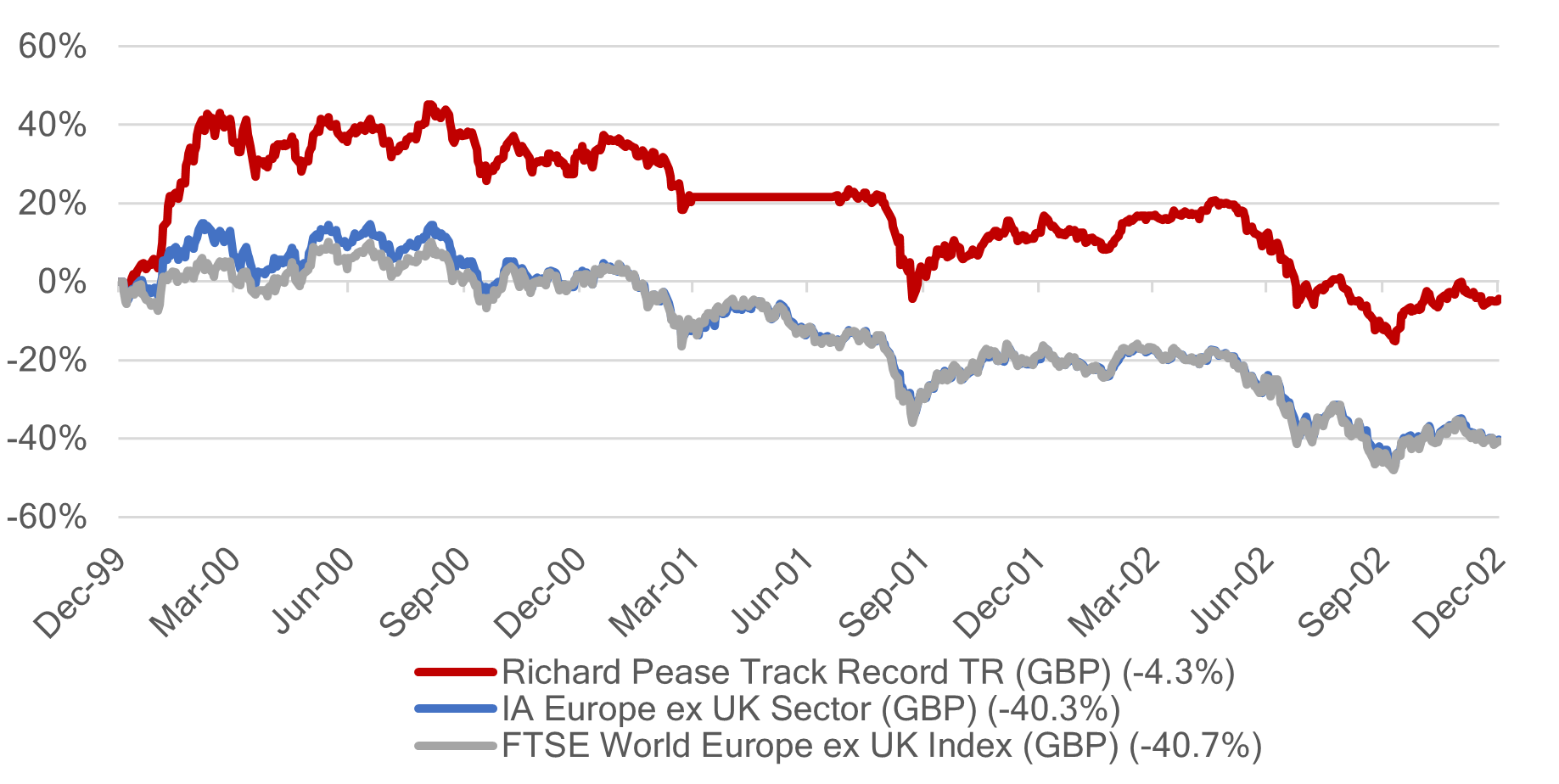

2000-2003: The strategy reduced exposure to very highly valued growth and technology stocks and pivoted to more reasonably valued and cash-generative industrial and business to business holdings with sensible balance sheets. This allowed the strategy to protect investors’ capital over the subsequent three year, outperforming its peers by 36% over the period.

Source FE Analytics, Bid-Bid basis, net income re-invested GBP. 30.09.2022

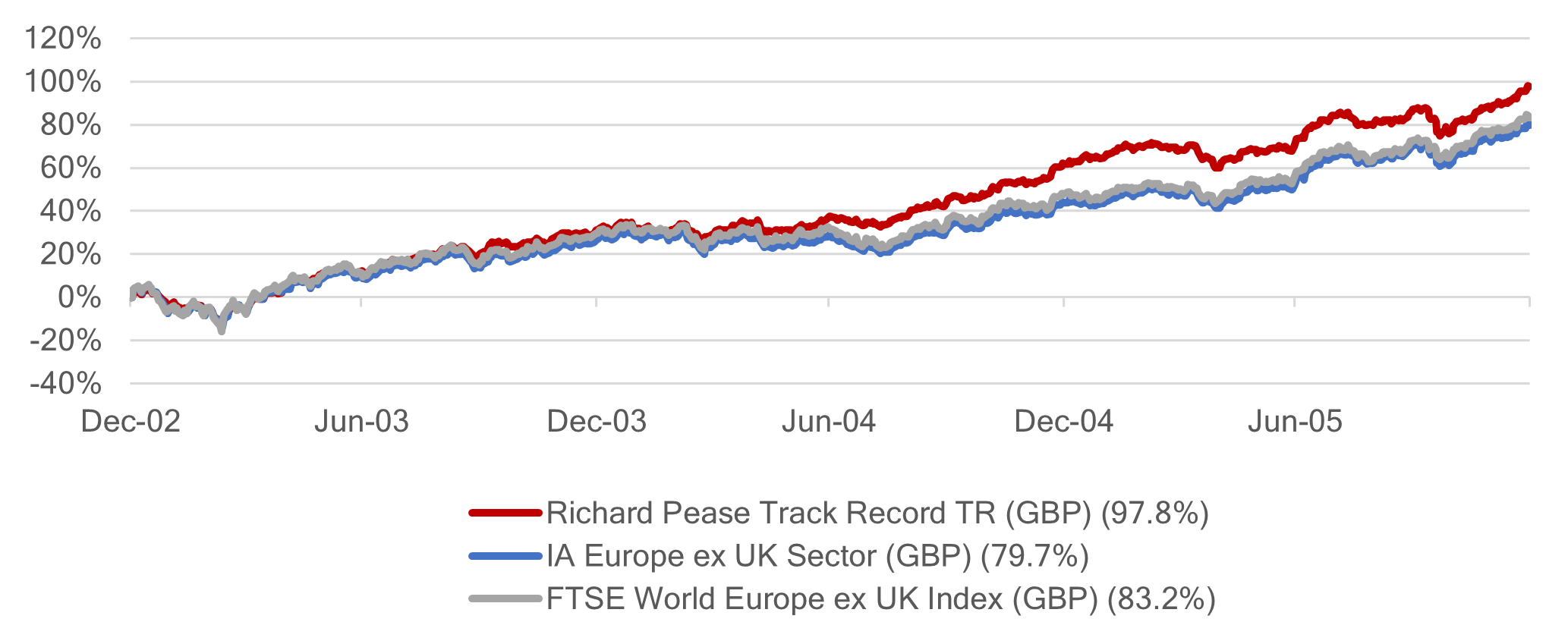

2003-2006: The strategy’s holdings benefited from a cyclical upturn (fuelled by falling interest rates) complemented by accretive bolt-on M&A. This allowed the strategy to outperform a very strong stock market and to outperform its peers by 18.1% over the period.

Source FE Analytics, Bid-Bid basis, net income re-invested GBP. 30.09.2022

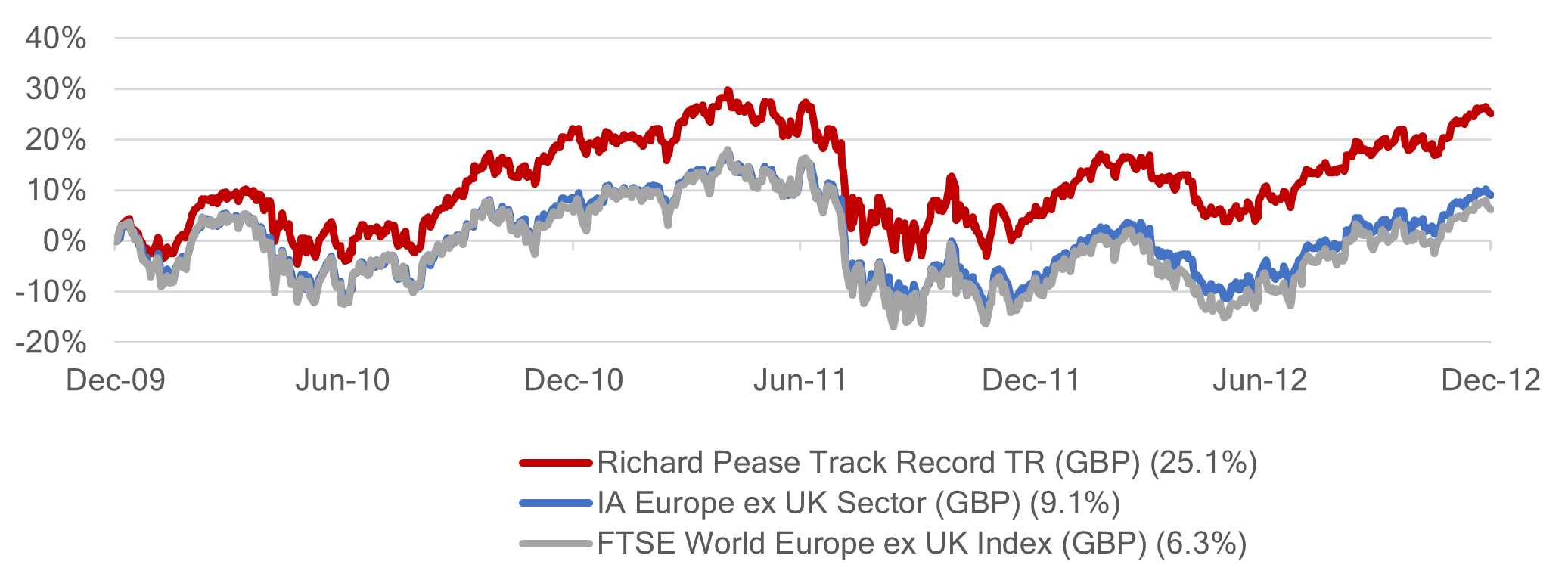

2010-2013: The strategy was underweight banks and mainline financials as their capital positions and unrecognised NPL exposures were deemed problematic. This allowed the fund to provide downside protection in a volatile market while ultimately capturing a good degree of the upside and hence outperforming its peers by 16% over the period.

Source FE Analytics, Bid-Bid basis, net income re-invested GBP. 30.09.2022

We would characterise today’s market backdrop as follows:

- Sustained inflation and rising rates have pressured the valuations of the technology and growth/quality stocks, which have driven market performance over the last five years. In many cases, however, the valuations of these stocks are still above historical averages and particularly so given the current rate environment.

- Stocks with any degree of business cyclicality have been sharply derated and in many cases price in a moderate 1-2 year recession.

- Financials have suffered slight derating due to fears of some loan losses. However, this has been partially or completely compensated by profits benefiting from higher rates.

- Outperformers this year have been stable, lowly rated businesses (e.g. big pharma) and commodity plays. The latter are beginning to roll over, however, given the weak macro environment.

The fund’s positioning reflects the following points:

- We continue to be underweight very highly-rated technology and perceived growth/quality stocks. This has hurt our performance over the last five years but has helped it YTD and especially over the last three months.

- Many of our cyclical holdings (e.g. Aalberts, Smurfit Kappa, Stroeer) are extremely undervalued on most metrics including EV/sales. We have added to several on stock price weakness.

- We have maintained positions in two banks, Bawag and Nordea. We believe that their loan books are low risk, their balance sheets are over capitalised and they should both benefit from higher rates leading to a more profitable brand network. We also hold Fineco, a financial growth stock, which is also a beneficiary of higher interest rates.

- We remain underweight in commodities. Recent relative performance over three months has improved and we believe the portfolio remains well-positioned in the current challenging environment.

Broadly we have been encouraged by our relative outperformance over the last three months, with the fund back in the top quartile vs its peers, and believe the portfolio is well-positioned to navigate the current market dislocation.

We would compare the current economic backdrop to 2002, which suffered a 1-2 year market downturn and recession followed by higher rates (which peaked at almost 5% in 2001/2002).

Modest valuations and strong balance sheets across our portfolio should both provide downside and the ability to fund opportunistic bolt-ons and market share gains.

Looking ahead, our exposure to growth and cyclicals should benefit the fund in a similar way to our experience in 2003-2006.

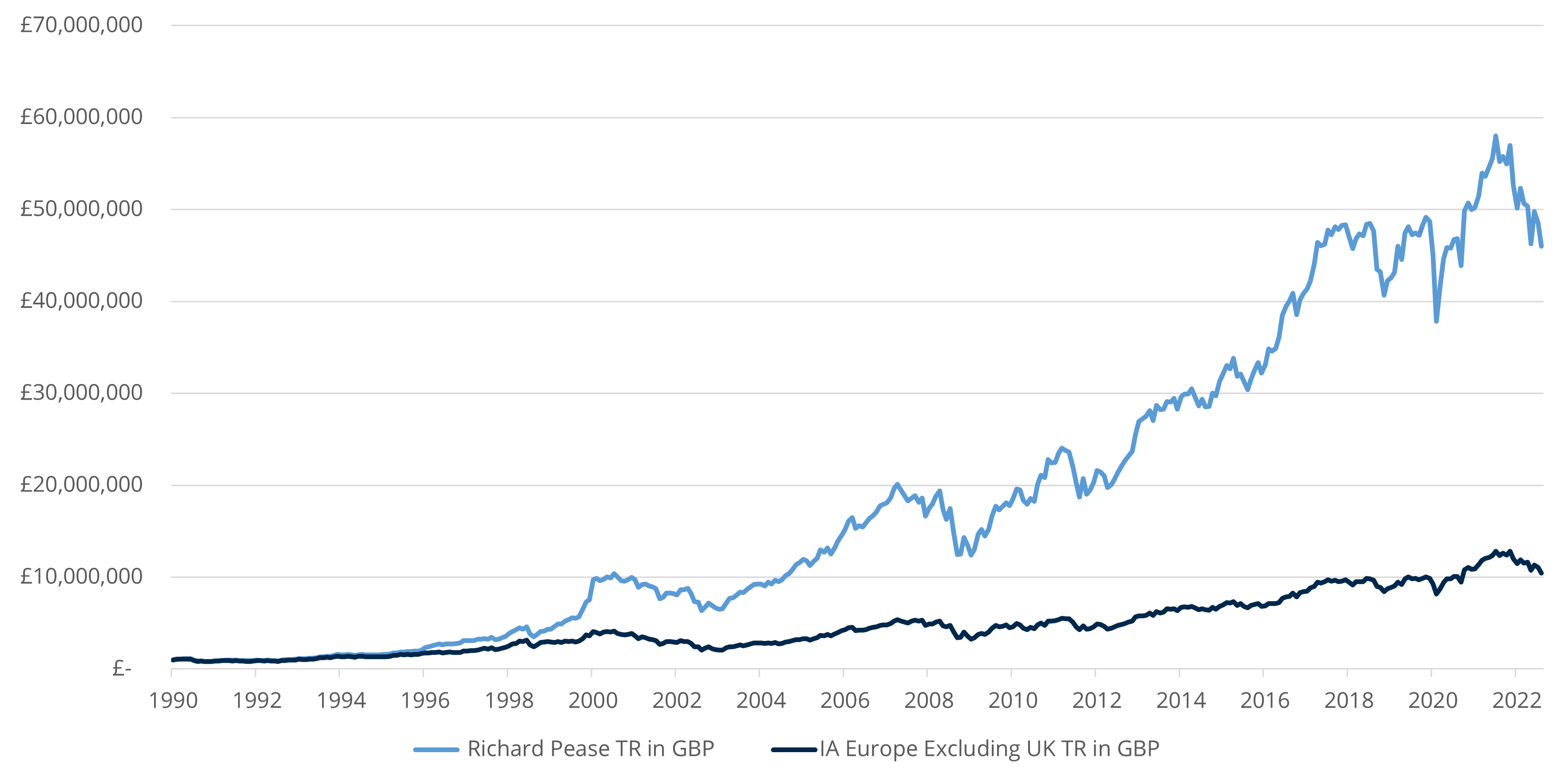

Richard Pease returns since inception